Find support with the legitimate trade of Carbon Credits from our gathering of experts at Enviroxperts and begin your business effortlessly

Package Inclusions :-

Outline regarding Carbon Credits

The industrialisation has shown to be exceptionally gainful for the general improvement of the world by working on individuals’ expectations for everyday comforts, producing more economy and expanding business rates. However, frequently, by seeing this turn of events, these results of industrialisation are discredited in light of its unsafe impacts on the climate. It has added to flighty environmental change, carbon credit, and an expansion in the nursery impact. A few specialists guarantee that the planet is continually warming quicker in 10,000 years.

The American Meteorological Society has characterized environmental change as any basic change in the drawn out measurements of environment parts north of quite a few years. The rising worldwide environment and its effect on the climate and human wellbeing have sought after numerous global and homegrown specialists to make rigid strides against establishments and organizations answerable for the outflow of nursery gasses and harming the climate.

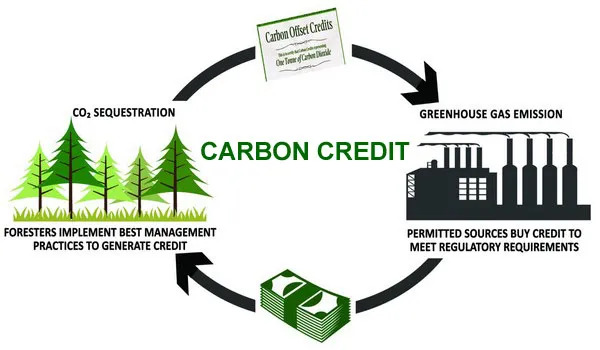

The foundation of carbon credits as an idea was to satisfy the worldwide strategy to direct the outflow of ozone depleting substances. It is characterized as the authorisation endorsement for organizations that give them the option to discharge one ton of carbon dioxide.

The unsafe impact of Greenhouse gases

Ozone harming substances essentially add to an Earth-wide temperature boost, environmental change and carbon credit. The carbon gases that are remembered for ozone harming substances are: –

- Carbon dioxide- Carbon dioxide contributes around 50-60 per cent to global warming.

- Hydro-fluorocarbons – This gas is mainly emitted from filing and refrigeration equipment leaks.

- Methane gas – This is the leading cause of trapping heat in the Earth’s atmosphere.

- Sulphur-hexafluoride- This gas is mainly emitted from the magnesium production industry andby the electrical and electronics manufacturing units.

Kyoto Convention

Kyoto convention was presented on 11 December 1997 and came into force on 16 February 2005. It is one of the broadly acknowledged conventions with around 192 signatories. Kyoto was sanctioned to carry out the Unified Countries Structure Show on Environmental Change connecting with committing the agricultural nations and other industrialized states to lessen ozone depleting substance (GHGs) emanations as per the objectives gave. The show likewise asks those states and nations to submit yearly reports on the actions taken to satisfy something very similar.

India's commitment toward Kyoto Convention

India turned into involved with the Kyoto convention in August 2002, having no commitment to satisfy the state of fossil fuel byproduct and fostering a public report on anthropogenic outflows. Under the convention, emerging countries have further commitments to execute public and territorial strategies to diminish an unnatural weather change while advancing imaginative innovation and decreasing or forestalling anthropogenic outflows of GHGs not constrained by the Montreal Convention in every significant area.

National Action Plan on Climate Change comprises of eight public missions zeroed in on improving the proficiency of imperativeness efficiency, sun powered innovation, and practical biological systems. Until this point, 7,814 Clean Development Mechanism (CDM projects have been enlisted all around the world, and 1,527 billion Certified Emission Reductions (CERs) from 2574 CDM projects have been delivered.

Carbon Credits

Carbon credits are the market instrument that is presented for the minimisation of the outflow of ozone depleting substances. Government specialists have drawn a line on how much GHGs outflows. In any case, for certain organizations or plants, sticking as far as possible is unthinkable. Subsequently, they are permitted to buy carbon credits to conform to the discharge covers from the market from somebody who has followed the objective. This interaction is called Carbon Exchanging.

Types of Carbon Credits

- Voluntary Emissions Reduction (VER): Carbon offset trade in the willful market or over the counter for credits.

- Certified Emissions Reduction (CER): Proposing to balance a venture’s emanations administrative system makes outflow credits. An outsider confirming body is the principal distinction between Intentional Discharges Decrease and Ensured Emanations Decrease.

Market outline of Carbon Exchanging India

As of late, India has advanced and sent off the market for Carbon Exchanging. This has made India one of the quickest developing carbon exchanging economies, producing carbon credits worth around 30 million, the second most noteworthy executed volume internationally. The carbon exchanging market India is creating at higher rates than some other area, including IT, biotechnology and Business Cycle Re-appropriating. India has very nearly 850 undertakings with a venture of roughly Rs. 650,000 million. Carbon is exchanged on our country’s Multi Product Trade, the principal trade to exchange carbon credits in Asia.

For carbon exchanging, two kinds of business sectors for the most part work the consistence market and the willful market. The consistence market is essentially the cap and exchange market, where one can guarantee the venture according to a clean development mechanism (CDM) and guarantee the credits by sticking to every one of the cycles. Then again, in the deliberate market, there are isolated independent libraries with their own standards and boundaries. In light of these standards and rules, the candidate needs to get his/her venture enrolled, evaluated, and confirmed by supported outsider assessors and get the carbon credits from these libraries.

Thus, the concerned party can guarantee carbon credits from one or the other or both the consistence and expected vault. They can then exchange them the worldwide market. One carbon credit is comparable to 1000 kilogram of fossil fuel byproduct decline relating or CO2 emanation decline comparing. This was as far as possible set by Joined Countries System Show on Environmental Change under the Perfect Advancement Component when the Kyoto Convention was sent off. Among the six perceived ozone harming substances, CO2 has been picked as the benchmark for working out carbon credits.

India is very potential in carbon exchanging business with its unexpected development the market and the support of a few major organizations in this field like TATA, Dependence, Birla, Ambuja, Bajaj and so forth. Besides, numerous different partnerships are expanding the credit of this market more.

Legitimate viewpoints overseeing carbon trading

Indias government drive to regularize carbon exchanging is reflected in the recently presented Energy Preservation (Change) Bill. The new reports of the World Bank show that India is assessed to command more than 20-25 percent of carbon exchange internationally, making it the world’s biggest recipient of carbon exchanging.

In India, carbon credit has been on Public Item &Derivatives Trade restricted to just a future agreement. A prospects contract is a steady understanding between two gatherings to exchange a clear resource of predictable amount and quality at an expressed date at a future cost concurred today. The arrangements are managed on a prospects trade. These arrangements are simply suitable to merchandise as portable property other than noteworthy cases, cash and protections. Additionally, contracts made for carbon credits in India are administered by the Indian Contract Act, 1872.

Energy Saving Authentications

Energy saving authentications are approved under Public Mission for Improved Energy Effectiveness. It is given to assembling plants that have saved energy by utilizing different techniques over their objectives. Further, on the off chance that any industry has not accomplished its objectives, buying energy-saving authentications from overachievers is worked with through exchanging declarations on the Power Trades Stage.

How could India help more from carbon credit and trading?

India can use various methods to extract benefits out of carbon credits and trading in the following ways: –

- The financial gain generated from carbon credit trading can be used to create profitable renewable energy projects.

- Carbon credits can be a driving force for many energy-saving initiatives if adequately used.

- The industry of carbon credit trading can also be used to open the market to new businesses related to the renewal of energy sources. Hence, creating more job opportunities for people and increasing our country’s GDP.

Carbon exchanging and decrease fossil fuel byproduct

Under the Kyoto convention, it is endorsed that agricultural nations don’t have a commitment to lessen their age of nursery gasses when contrasted with created nations. In this way, assume the nations decrease their fossil fuel byproduct by taking on different strategies like sunlight based charger plants or establishing trees. All things considered, they could sell their carbon credit to the created nations to finish their objective. This methodology will urge non-industrial nations to diminish their fossil fuel byproducts, and created nations as of now have their commitments to satisfy.

Challenges looked during carbon trading

The carbon credit framework depends on the Kyoto convention, which set targets lapsed in 2012. After this, there have been a great deal of changes and revisions in the market which were not considered.

In India, a few tasks have a huge measure of carbon credits, however their reasonable worth isn’t assessed accurately, beating new organizations and the general market climate down. Aside from this, tax collection is likewise an extremely enormous concern. There has been a vagueness about the duty forced on pay created through carbon credits. There is an extensive interest from a specific part of carbon credit financial backers that the pay created from it should be tax-exempt.

How will Enviroexperts Assist You?

| Customized legitimate help | Help in yearly report recording | Support on petitioning for recharging |

| Our legitimate specialists offer help through the method involved with acquiring Carbon Credits. | We offer complete direction independently taking care of your particular necessities. | Our master group likewise conveys careful help for applying for legitimate trade of Carbon Credits. |